APPLICATION FOR INCOME TAX EXEMPTION APPROVED: INSIMBI LEGACY PROJECTS NPC; PBO NO 930068309 The Representative INSIMBI LEGACY P

Explanatory Note Clause X: Deduction of income tax at source: tax avoidance Summary Details of the clause

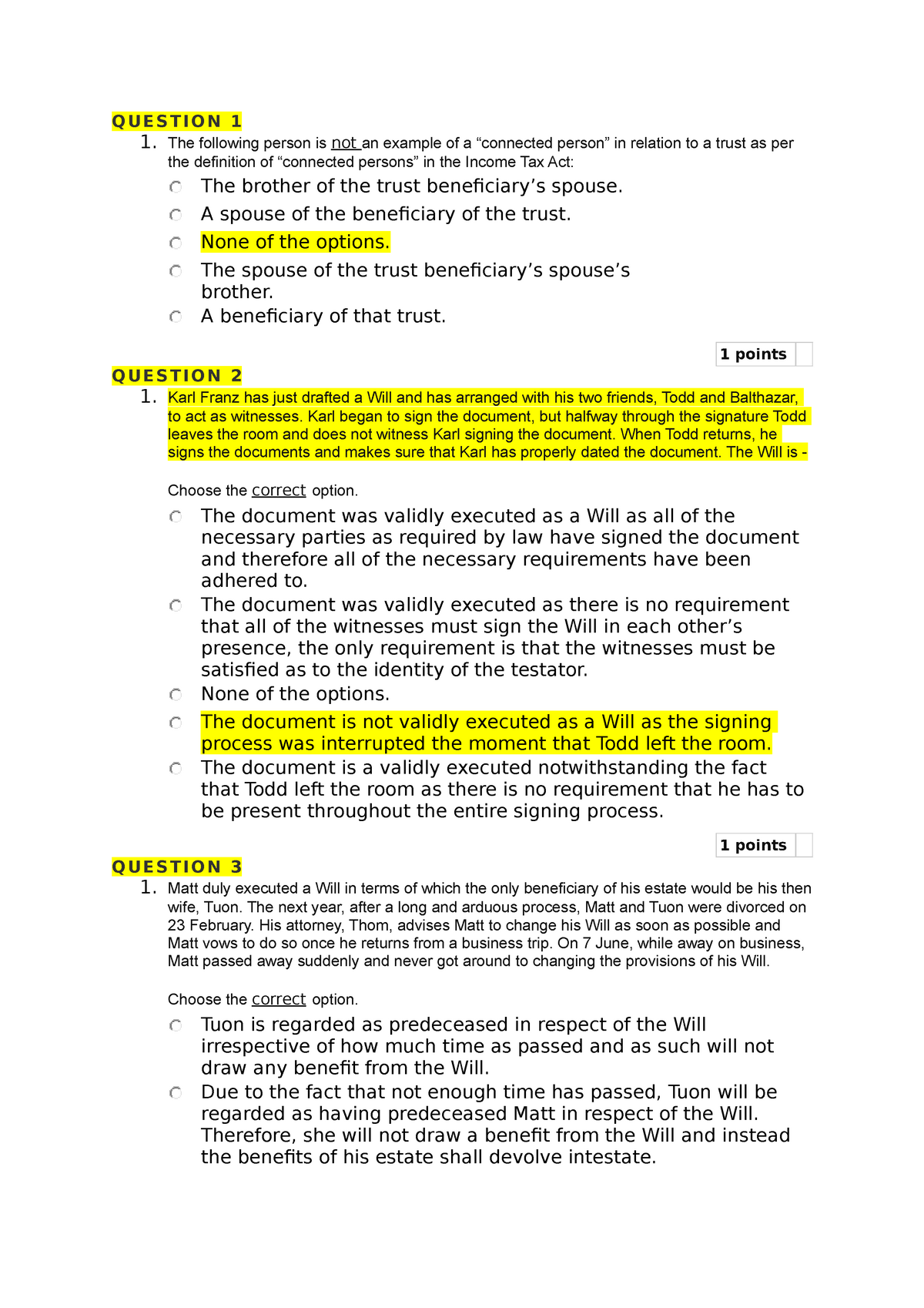

Quiz 1 LFPA 2021 - First Assignment - QUESTION 1 1. The following person is not an example of a - Studocu