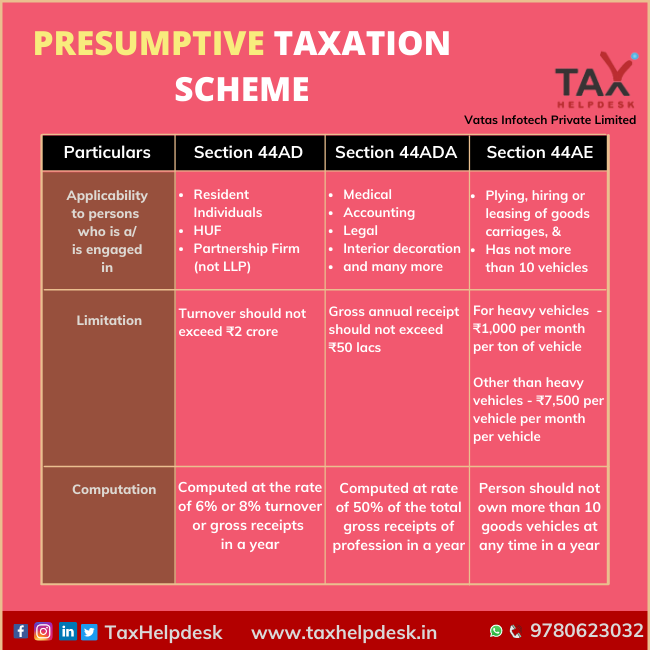

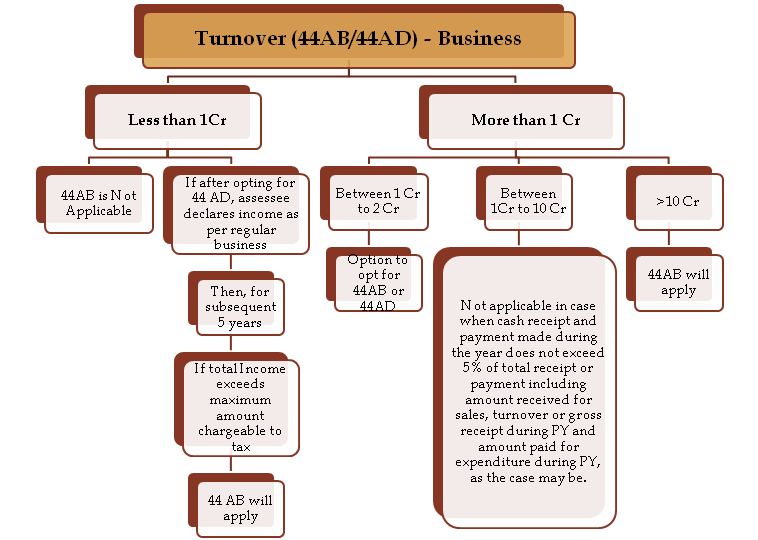

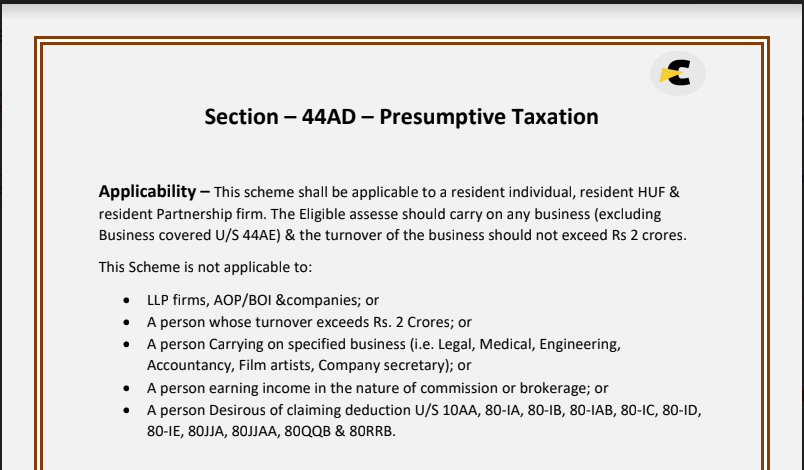

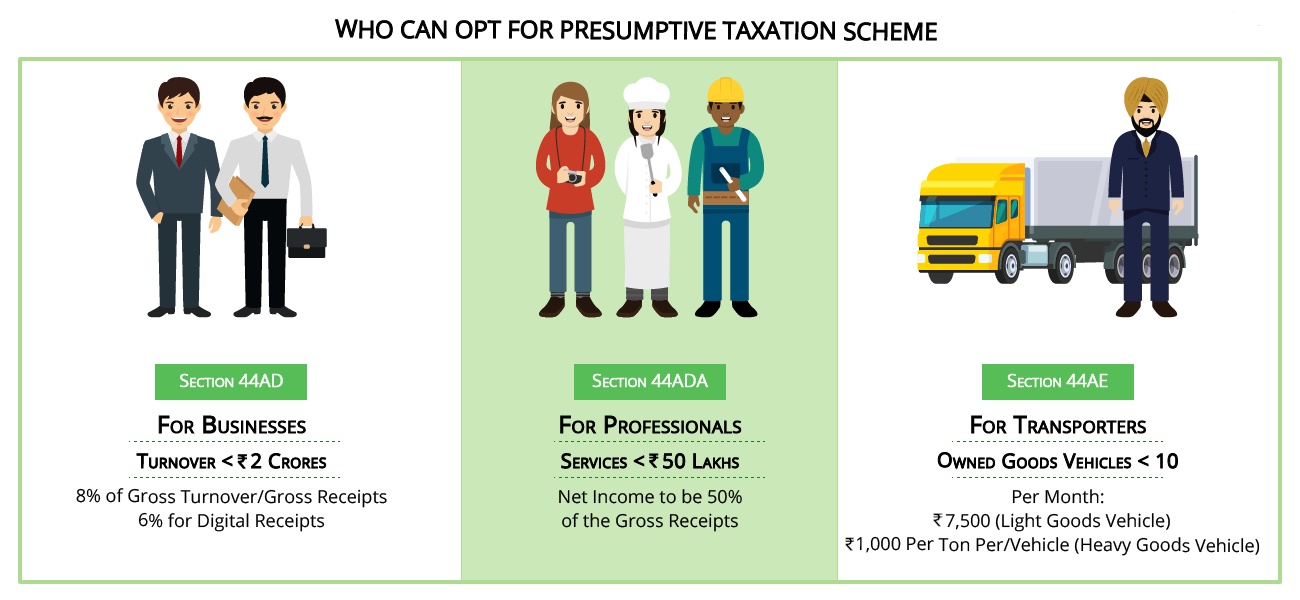

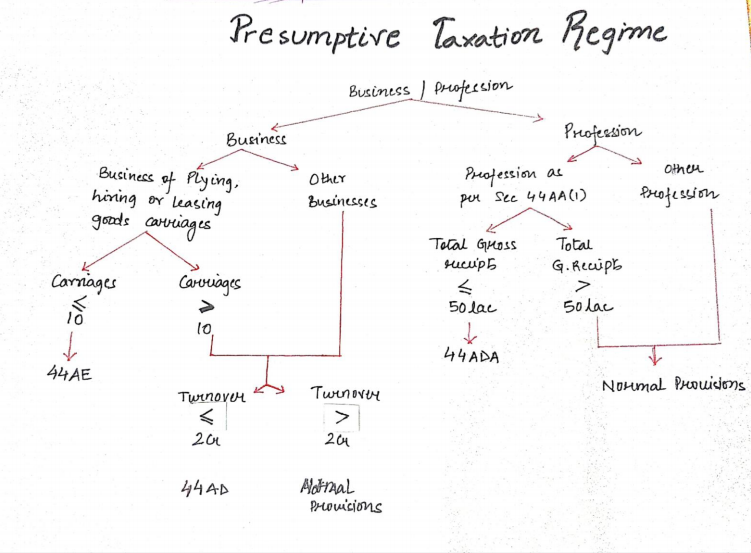

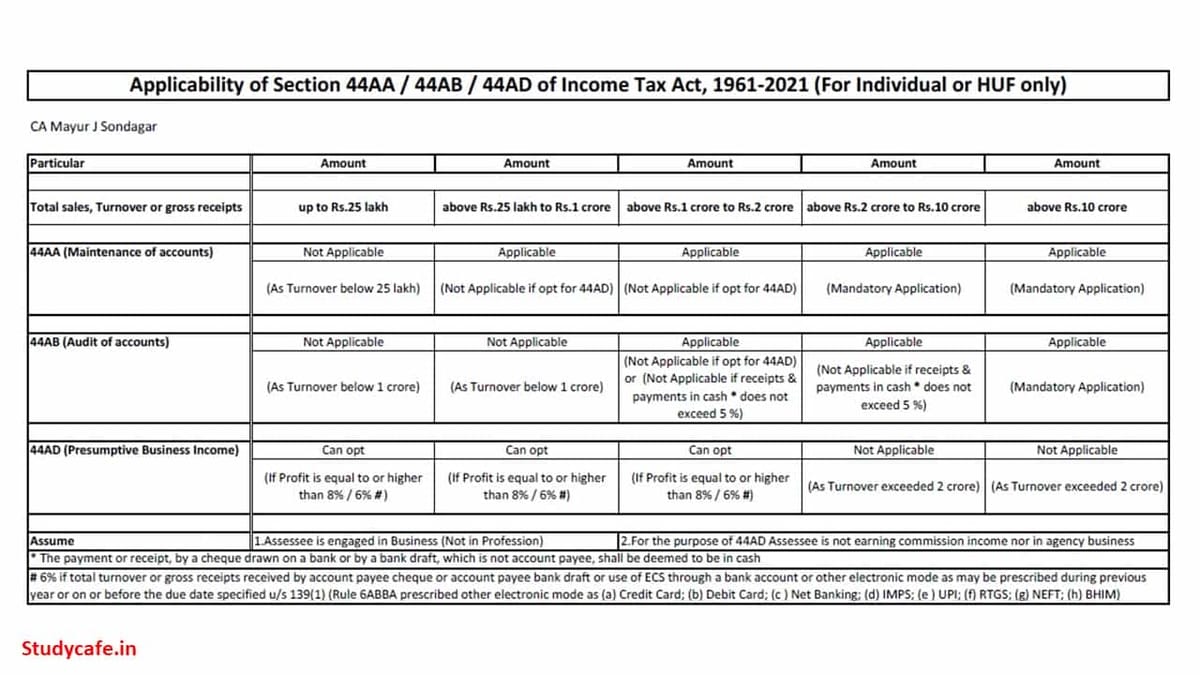

CA Tax Academy - Income Tax Return: Filing Sugam ITR-4S is easy. You can finally bid adieu to your CA ------------------------------------------------------------- The Presumptive Taxation Scheme (ITR-4 or Sugam) enables small businesses and

Books of Accounts Need not be Maintained If Income is Offered on Presumptive Basis u/s 44AD of IT Act: ITAT deletes Addition against Vegetable Vendor